The New Operating Model

IntroductIon The insurance industry will suffer a dramatic loss of human and intellectual capital as a rapidly aging workforce moves into retirement. The loss of so much domain expertise seems alarming enough. When combined with industry-specific technology challenges; expanded regulations; increased customer expectations; cost-control pressures; new competitors; and a recruitment-resistant millennial workforce, this shortage becomes a tempest — one for which even successful insurance organizations are ill-prepared. As intellectual continuity diminishes, the industry will need to reexamine operating models. New sources of initiative, resourcefulness, ingenuity, and agility must be available to re-engineer processes, sustain growth, and to integrate new technologies effectively. Insurers will increasingly be distinguished by the extent to which they can continually improve core processes, enhance policyholder services, and mitigate costs. Leading insurers will maintain competitive advantages by working with the equivalents of knowledgeable rapid-response teams that are strategic in their approaches and flexible in their methods. Their tools will be experience, expertise, and technical prowess. Their tactics will be situation-specific. And they’ll be the intellectual and operational equivalents of insurance companies without the requisite capital reserves or underwriting authority. Accordingly, this paper details an operating model that delivers flexible, responsive, cost-effective, consultative, industry-expert and consultative enrichment — Strategic Operations Support or SOS — that delivers: ǡ DIFFERENTIATION - Instituting a controlled but fluid environment driven by efficiency, reliability, transparency, and knowledge transfer. ǡ AGILITY - Accommodating growth and scalability without juggling priorities and project teams. ǡ TRANSFORMATION - Moving the organization from staff-heavy overhead to objective- specific expertise. ǡ AUTOMATION - Capitalizing on technology to reduce costs, minimize errors, optimize efficiency, and ensure regulatory compliance. In short, the insurer of the near future will maintain competitive advantage by working with the equivalents of knowledgeable rapid response teams. They’ll respond quickly. They’ll be flexible in their delivery methods. They’ll be strategic in their approaches. Their tools will be experience, expertise, technical prowess, and industry authority. Their tactics will be situation-specific. And they’ll be the intellectual and operational equivalents of insurance companies without the requisite capital reserves or underwriting authority. It details the challenges facing insurers and the industry. And it positions SOS as the model by which the industry can anticipate, embrace, and manage change, regardless of its nature.

realIty, by the numbers The number of insurance professionals over age 55 increased 74 percent between 2007 and 2017. The U.S. 1 Further, Bureau of Labor and Statistics projects one-quarter of those professionals will retire before 2027. the domain experts who remain employed struggle to keep up with the fastest pace of data and technology 2 change in more than a generation. Shortages of time and talent will make staffing difficult. The next generation of workers will likely lack the requisite domain expertise. A recent survey of millennials, who represent 50 percent of today’s workforce, 5 The Jacobson Group found less than 10 percent of them show any interest in the insurance industry. 6 recruitment firm notes, “The mass talent shortage is here, and insurers must take action.” And there’s more … According to another recent study, 95 percent of senior insurance executives doubt their operating models are suited to the barrage of rapid, unrelenting change. Its findings suggest there are four value-creating components on which insurers must focus: leadership, organization architecture, people (with the right skills 7 and competencies), and processes and technology. Another study found 95 insurance CEOs in 39 countries recognize cost-cutting alone will not sustain long- term growth. They need “a much more fundamental transformation in strategy, innovative capacity and operational capabilities.” 81 percent of the respondents were “extremely concerned” about the “availability 10 of key skills,” second only to worries over the “speed of technological change.” Insurers must replace tactical cost reduction and labor outsourcing with strategic expertise: “Complementary capabilities, not just cost reduction ... can significantly improve efficiencies, reduce costs, 8 and foster a focus on the things that add value.” SOS: THE NEW OPERATING MODEL

In more specific terms, insurers will need to be most mindful of: 1. TECHNOLOGICAL DEVELOPMENTS. Robotic process automation (RPA) and artificial intelligence (AI) will streamline operations and lower costs. New distribution channels will increase competitiveness. Insurers struggling with legacy modernization, emerging technologies, structured and unstructured data sources, and data science to inform decision-making will fall behind. The relentless change will push the industry’s risk-aversion well out of its comfort zone. Capgemini’s 2017 trends report notes two forces driving the industry’s evolution: “connected 3 — forces foreign to late-career insurance professionals. technologies and data analytics” 2. INCREASED REGULATION. The National Association of Insurance Commissioners’ post-2008 Risk and Solvency Assessment suggests lack of expertise in region-specific insurance regulatory requirements — with a corresponding lack of data analytics technological capabilities — cause 4 insurers to struggle with forecasting, scenario-planning, stress-testing, and risk-assessment. 3. EVOLVING CUSTOMER EXPECTATIONS. Policyholders and producers expect online and mobile tools to enhance their experiences, to give them greater insight, to provide increasingly accurate premiums and lower claims costs, and to help them understand coverages and pricing. 4. EXTERNAL PRESSURES. The race to keep up with items 1-3 squeezes profit margins and necessitates cost controls. Many insurers lacking the internal capacity and expertise to address such threats are hard-pressed to create process improvements with which to compete and differentiate. Just as meteorological storms pay no heed to what they upend, the perfect storm of knowledge and skill deficits will upend insurance organizations of every size: Large re/insurers with simultaneous initiatives, insurers, brokers, MGAs with modernization needs, and start-ups with shortages of resources and expertise — all must refresh their approaches and resources to manage the insurance lifecycle. The future will be dramatically different in form and function for insurance organizations of all stripes. So, they must also have access to a new model and requisite resources to bolster their growth and productivity.

the PrIncIPles of sos Insurance organizations will need to incorporate expertise, skills, responsiveness, flexibility, and technical facility to better navigate the evolving nature of the industry. To ensure those attributes — and in recruiting and retaining them in-house — SOS provides: 1. SAVINGS. Given the pace of change and the reality of competitive pressure, there’s no more room for scope creep and cost overruns. SOS improves combined ratios by saving significant amounts of time and money. 2. CONTROL. SOS ensures knowledge transfer, imparting skills and insight to core staff members, even as they organizations free those people to achieve corporate objectives. That will allow 9 and better insurers to “attract the best and the brightest newcomers to the industry workforce” control outcomes. 3. GOVERNANCE. SOS parallels the scope, authority, and organizational structures of insurers, provides a single point of contact, operates under the organizations KPIs, and keeps projects on track. SOS also provides the kind of forthright advice insurance organizations expect from experienced internal sources. SOS delivers demonstrable currency in insurance operations, evolving trends, emerging technologies, and every aspect of the insurance lifecycle, along with credentials, designations, and the hands-on familiarity expected of internal staff members. And SOS provides expert proficiency in all the disciplines illustrated in Figure 1.

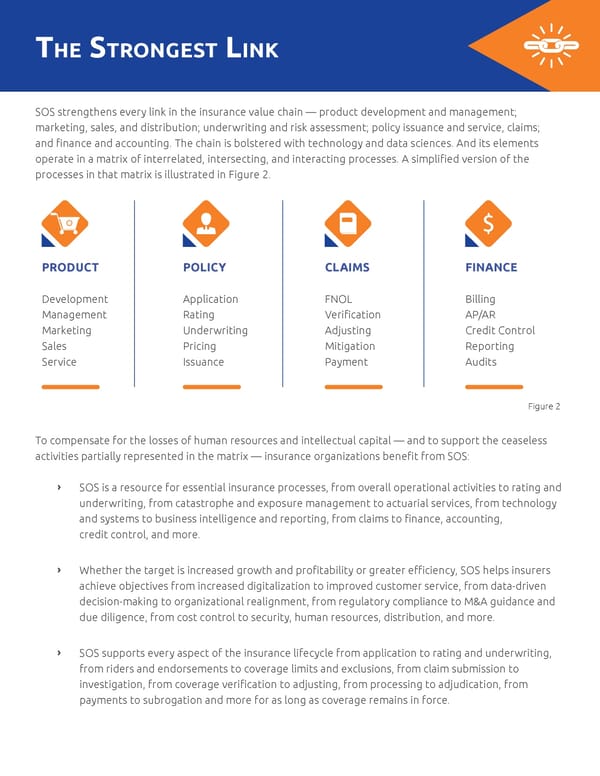

the strongest lInk SOS strengthens every link in the insurance value chain — product development and management; marketing, sales, and distribution; underwriting and risk assessment; policy issuance and service, claims; and finance and accounting. The chain is bolstered with technology and data sciences. And its elements operate in a matrix of interrelated, intersecting, and interacting processes. A simplified version of the processes in that matrix is illustrated in Figure 2. PRODUCT POLICY CLAIMS FINANCE Development Application FNOL Billing Management Rating Verification AP/AR Marketing Underwriting Adjusting Credit Control Sales Pricing Mitigation Reporting Service Issuance Payment Audits Figure 2 To compensate for the losses of human resources and intellectual capital — and to support the ceaseless activities partially represented in the matrix — insurance organizations benefit from SOS: ǡ SOS is a resource for essential insurance processes, from overall operational activities to rating and underwriting, from catastrophe and exposure management to actuarial services, from technology and systems to business intelligence and reporting, from claims to finance, accounting, credit control, and more. ǡ Whether the target is increased growth and profitability or greater efficiency, SOS helps insurers achieve objectives from increased digitalization to improved customer service, from data-driven decision-making to organizational realignment, from regulatory compliance to M&A guidance and due diligence, from cost control to security, human resources, distribution, and more. ǡ SOS supports every aspect of the insurance lifecycle from application to rating and underwriting, from riders and endorsements to coverage limits and exclusions, from claim submission to investigation, from coverage verification to adjusting, from processing to adjudication, from payments to subrogation and more for as long as coverage remains in force.

to boldly go... Insurers bold enough to revisit and reevaluate their operating models will be leaders. They’ll lead by example, and by functional, responsive ability. They’ll lead by the currency of their skills and their technology. They’ll lead by the volume of business, the freshness of products, and the specificity of knowledge within their organizations. They’ll lead by efficiency and profitability. With SOS, they’ll get the help they want. They’ll meet their requirements and overcome their challenges. They’ll be able to prioritize and complete strategic projects. And they’ll satisfy the needs for: REACH, with multinational, native-language teams in each country served RESOURCES to cover personnel shortages, technology challenges, customer expectations, competitive threats, and recruitment OPERATIONAL CHALLENGES such as legacy software; data access, sharing, and analytics; cost control, business processes; change management; and attrition STRATEGIC CHALLENGES such as growth, market share, regulatory compliance, distribution, and application development

the ImPact of technology A continuing soft insurance market and low-interest rates compel re/insurers to focus on cost control and expense reduction. Technology can help reduce frictional costs, create efficient distribution channels, provide better digital services to re/insurers, and boost policyholder retention and renewals. Also, technology continues to improve business processes with artificial intelligence, robotics, and automation. Those improvements are among the core value propositions of SOS. Technology is much more affordable and adoptable now, and interactive technology enables the kind of responsiveness policyholders increasingly expect. SOS manifests the expertise and consultative services that can improve every operational aspect of the insurance lifecycle, from the boardroom to the back office. But technology does nothing more or less than assist the people and processes by which re/insurers excel —consolidating intellectual capital, optimizing processes, enabling digitalization, and more. SOS delivers the problem-solving proficiency derived from serving a wide range of insurance organizations, across diverse regulatory jurisdictions and business environments worldwide. For example, the SOS connection of technology and data sciences can personalize pricing, as more and more risk-specific data becomes available. Insights from driving behavior, health matrices, connected homes, loss detection and prevention tools like mechanical system alerts, water leakage alarms, and roadside assistance programs can add new dimensions to risk management, product design, and policyholder service. SOS drives intelligent automation to transform the everyday business of insurance, removing redundancies and inefficiencies in underwriting, claims processing, and back-office operations across the entire insurance lifecycle. The flexibility of SOS also enables the realization of adaptive target operating models that support operational transformation and process optimization derived from rigorous, dynamic benchmarking and individualized operational analytics. Those models provide customizable blueprints for clearly defining ‘desired states,’ helping re/insurers respond to industry fluctuations constructively, whether their needs are for capacity, top-line growth, cost containment, or any other aspect of their operations.

A PRUDENT APPROACH TO TECHNOLOGY TRANSFORMATION As a first step, re/insurers looking to overhaul their enterprise technology landscapes must define the ‘current state’. The current state would help organizations build a technology road map, align the roadmap with business objectives, and identify digital skills and other resources required for running a successful transformation program. The following insurance technology maturity framework provides re/insurers and producing intermediaries a starting point for carrying out their current state analysis: Insurance Technology Maturity Curve Business Value Efficiency Customer Satisfaction Operating Cost Technological Maturity Stage 1 Stage 2 Stage 3 Stage 4 ACCELERATE AUTOMATE INNOVATE Appendix I elucidates how the IT landscape looks at the application, data, and infrastructure level for re/ insurers to identify the stage of the insurance technology maturity pertaining to them. Making a case for progressing from one stage to the next requires business decision-makers to determine the technology gaps the organization faces: ǡ STAGE 1: Maintaining legacy infrastructure and end of life applications poses serious risk and cost. The amount of money being spent on supporting obsolete technology is continuously increasing every year. Older systems also expose companies to greater cyber risks, since they are more susceptible to malware. Those systems are also difficult to patch, requiring customized, costly, and time-consuming workarounds. Mainframe applications and MS Excel-based processes still require almost 80 percent of tasks to be carried out manually, adversely affecting productivity. Ineffective data management prevents organizations from gaining actionable insights into operational and financial data, adversely affecting decision-making. Putting a dollar value on all that risk, loss, profitability, and lack of competitive edge can help CIOs build a solid case for moving to Stage 2 or 3.

ǡ STAGE 2: Companies at this stage have access to enterprise applications; however, they face responsiveness challenges because of the software’s archaic architecture. Launching a line of business or penetrating a new geography needs agility and accuracy, an impossible task for outdated systems. Siloed data presents challenges with reliability, governance, access, inconsistent search, and incomplete views. Though companies at stage 2 tend to have well-defined processes, they still need significant manual intervention to perform repetitive, non-value-adding activities such as extracting data from paper-based documents and inserting it into the correct fields within web-based forms. CIOs looking to reduce operational expenditures, increase throughput, minimize human error, and optimize resources should automate processes across the software development lifecycle (SDLC) and invest a considerable portion of their IT budgets towards graduating to stage 3. 11 ǡ STAGE 3: A recent survey by Willis Towers Watson (WLTW) showed that 58 percent of senior insurance executives say they are behind other financial services when it comes to digital technology in particular. Hence, based on our framework, insurance companies at the third stage of the technology maturity curve are considered ‘early adopters,’ given their strategic investments in single-page responsive applications, the agile SDLC model, CI/CD practices, automation tools, and enterprise integration techniques. The role of technology evolves at this stage from an ‘enabler’ to a powerful tool for driving large-scale transformation and gaining first-mover advantage. CIOs at this stage must look for ways to expand the business, disrupt the market, and achieve a competitive edge using 4IR technologies such as the internet of things (IoT), telematics, machine learning, artificial intelligence, and Big Data analytics. The idea is to replace traditional business models with new ones that enhance customer satisfaction, promote sustainable business growth, and drive product differentiation. At every stage of the insurance technology maturity curve, strategic partnerships with technology consulting and service providers can help re/insurers achieve digital transformation, cutting down on time and cost. Refer to Appendix II to learn more about ways in which insurance-focused technology experts can help re/insurers move up the maturity curve.

a Word about oPPortunIsm Frequently and unfairly, there are negative connotations attached to the words, opportunism and opportunistic. Why? Competition, commercial or otherwise, depends on nimble responses to opportunity. In this specific case, insurers need to be opportunistic in response to market developments, consumer demand, technological potential, and other emergent matters. Ironically, when insurers are not so nimble or responsive, they’re likely to refer to their failures to capitalize as lost opportunity and to refer to what’s been lost as opportunity cost. But the new world of insurance, which will necessarily require a new operational approach, will leave little room for lost opportunity. Rather, it will require insurers to be agile enough to examine all opportunities and to have the resources at their disposal to take advantage of the ones that have the most potential for competitive advantage and category dominance. In this context, SOS lets insurers maximize opportunities and minimize opportunity costs.

aPPendIx I The following table showcases the technology stack at every stage of the insurance technology maturity framework, ie: the application landscape, data and analytics environment, and IT infrastructure. IT decision makers at insurance organizations may use the table to identify and define the current and desired stage of digital maturity: STAGE 1 STAGE 2 STAGE 3 STAGE 4 Applications ǡ Mainframe-based ǡ Monolithic ǡ Commercial-off- ǡ Enterprise applications enterprise the-shelf (COTS) applications ǡ MS Excel/Access- applications for and customized integrated with based processes underwriting, single-page exponential claims, and billing applications technologies ǡ Defined workflows ǡ OCR and –blockchain, Robotic Process artificial ǡ Siloed data Automation (RPA) intelligence, machine learning, ǡ Enterprise mobility IoT, telematics, and ǡ Agile software drone technology development ǡ DevOps and and ‘continuous gamification integration and continuous TE TE delivery’ (CI/CD) TE A ǡ Robust integration A OMA via APIs to V CELER facilitate a single C UT source of truth INNO A A Data and ǡ Un-normalized, ǡ Relational, clean ǡ Heterogeneous ǡ Big Data Analytics undefined data data from well- data from multiple ǡ Intelligent, ǡ Limited insights structured sources sources, in multiple prescriptive into business ǡ Descriptive formats, speeds, analytics processes analytics and sizes ǡ Predictive analytics IT ǡ Legacy ǡ Client-server ǡ Microservices ǡ Serverless Infrastructure infrastructure model architecture architecture ǡ Service-oriented ǡ Public, private, ǡ Hyper-converged architecture (SOA) and hybrid cloud infrastructure infrastructure ǡ Software-defined ǡ Infrastructure-as- networking (SDN) a-service (IaaS)

aPPendIx II Technology consulting and insurtech partners can help insurance organizations accelerate digital maturity through strategic interventions – accelerate, automate, and innovate. The following table enlists targeted measures IT decision makers must take to graduate from one stage to the next of the insurance technology maturity framework: ACCELERATE AUTOMATE INNOVATE Develop and deploy Customize and deploy Successfully integrate SOA-based modular web commercial-off-the- cognitive technologies applications for underwriting, shelf (COTS) enterprise such as image processing, rating and price engine, software and white- sentiment analysis, artificial CAT modeling and exposure labeled applications, while intelligence, machine management, claims, and implementing dockerization learning, and neural network billing and microservices processing with existing enterprise systems Digitize processes by Optimize the user experience Harness the power of the implementing workflow and ensure system reliability internet of things (IoT) by management, document and responsiveness through deploying and managing management, customer continuous integration, sensor devices including relationship management, deployment, testing, and health tracking monitors, content management, and monitoring. Expose APIs on-board diagnostics (OBD) user management to interact effectively with devices, and water and gas producing intermediaries sensors to prevent mishaps GE 1 GE 2 GE 3and simplify claims processes GE 4 A Enhance extendibility, A Drive enterprise-wide A Reinvigorate application A T T T T S adaptability, scalability and S automation initiatives S lifecycle management by S reusability by implementing leveraging robotic process achieving DevOps maturity, state-of-the-art architecture automation, OCR, NLP, IVR, improving agility and and chatbots operational support Streamline data management Establish sophisticated data Build a robust data lake and by setting up a relational management processes create a Hadoop ecosystem database, standardizing the for data warehousing, to manage large volumes of data in line with standards integration, archival, purging, disparate data and support such as ISO, ACORD, etc., and retrieval. Enable 3rd- Big Data analytics migrating the data, and party integration with enabling dashboards and external data sources via reporting APIs, SDK, and PaaS Move computing from the mainframe to the client-server model (n-tier Achieve risk-free cloud migration for various cloud deployment deployment), and enable models – public, private, and hybrid, and automate network hardware virtualization, management, server monitoring and notifications management. clustering, and load balancing

references 1. Yoder, Jamie. “Top 7 Insurance Industry Concerns for 2017.” PropertyCasualty360. 2. p.2, Human Capital Trends in the Insurance Industry. Deloitte. 3. p.1, Top 10 Trends in Insurance in 2017. Capgemini. 4. p.1, Own Risk and Solvency Assessment (ORSA). NAIC & The Center for Insurance Policy and Research. 5. p.10, Human Capital Trends in the Insurance Industry. Deloitte. 6. p1. 2016 Insurance Industry Talent Trends. The Jacobson Group. 7. Accenture Insurance Follow. “Insurers - Is Your Operating Model Standing in the Way of Growth.” LinkedIn SlideShare. 8. pp. 5 & 7. The Aging Workforce: Lessons for the Insurance Industry from America's Pastime. PwC. 9. pp. 6 & 12. Embracing Possibility, Boosting Innovation. PwC. 10. p.7, Human Capital Trends in the Insurance Industry. Deloitte. 11. Ismail, N. (n.d.). "Insurance is falling behind when it comes to technology expectations." Information Age. About Xceedance Xceedance is a global provider of strategic consulting and managed services, technology, and data sciences to insurance organizations. Domiciled in Bermuda, with offices in the United States, United Kingdom, Germany, Poland, India, and Australia, Xceedance helps insurers launch new products, drive operations, implement intelligent technology and blockchain solutions, deploy advanced analytic capabilities, and achieve business process optimization. The experienced insurance professionals at Xceedance enable re/insurers, brokers, and program administrators worldwide to enhance policyholder service, enter new markets, boost workflow productivity, and improve profitability. For more information, visit www.xceedance.com or write to us at [email protected]. USA UK Germany Poland India Australia