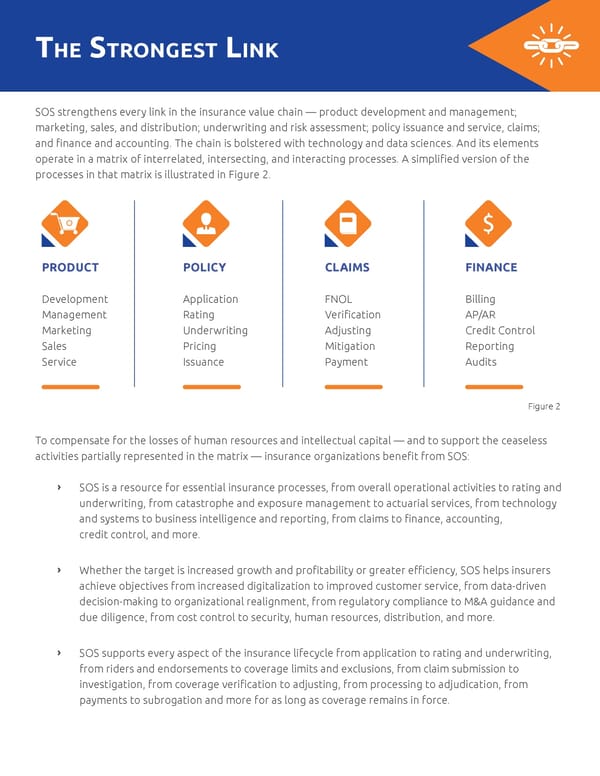

the strongest lInk SOS strengthens every link in the insurance value chain — product development and management; marketing, sales, and distribution; underwriting and risk assessment; policy issuance and service, claims; and finance and accounting. The chain is bolstered with technology and data sciences. And its elements operate in a matrix of interrelated, intersecting, and interacting processes. A simplified version of the processes in that matrix is illustrated in Figure 2. PRODUCT POLICY CLAIMS FINANCE Development Application FNOL Billing Management Rating Verification AP/AR Marketing Underwriting Adjusting Credit Control Sales Pricing Mitigation Reporting Service Issuance Payment Audits Figure 2 To compensate for the losses of human resources and intellectual capital — and to support the ceaseless activities partially represented in the matrix — insurance organizations benefit from SOS: ǡ SOS is a resource for essential insurance processes, from overall operational activities to rating and underwriting, from catastrophe and exposure management to actuarial services, from technology and systems to business intelligence and reporting, from claims to finance, accounting, credit control, and more. ǡ Whether the target is increased growth and profitability or greater efficiency, SOS helps insurers achieve objectives from increased digitalization to improved customer service, from data-driven decision-making to organizational realignment, from regulatory compliance to M&A guidance and due diligence, from cost control to security, human resources, distribution, and more. ǡ SOS supports every aspect of the insurance lifecycle from application to rating and underwriting, from riders and endorsements to coverage limits and exclusions, from claim submission to investigation, from coverage verification to adjusting, from processing to adjudication, from payments to subrogation and more for as long as coverage remains in force.

The New Operating Model Page 5 Page 7

The New Operating Model Page 5 Page 7